proline-penza.ru

Prices

Is Llc The Same As Sole Proprietor

Sole proprietorships and LLCs are two of the most common business structures in the US. Sole proprietor is the simplest structure to adopt, while an LLC. If you operate a sole proprietorship, you are the only participating owner and there are no other members. An LLC can have other participating members. Each. An individual owner of a single-member LLC that operates a trade or business is subject to the tax on net earnings from self employment in the same manner as a. Whether you function as an LLC or as Sole Proprietor, your taxes will be the same. Sole Proprietorship is less paperwork and quicker at the upstart. An LLC. The single member LLC is the simplest to form. It is taxed the same as a sole proprietorship. Profits or losses pass through to the owner via Schedule C. A. Plus, the owner and the business are the same, which means tax filing is an easy process. Many sole proprietors do their own taxes. An LLC is different. The. It is simple to form a sole proprietorship. You do not need to register, and it is easier to manage and file taxes. However, your personal assets are not. While the federal taxes paid should be the same for a sole proprietorship and an LLC being taxed as a pass-through entity, some states have additional taxes for. The single biggest advantage of an LLC over a sole proprietorship is personal liability protection. If you register your business as an LLC, your personal. Sole proprietorships and LLCs are two of the most common business structures in the US. Sole proprietor is the simplest structure to adopt, while an LLC. If you operate a sole proprietorship, you are the only participating owner and there are no other members. An LLC can have other participating members. Each. An individual owner of a single-member LLC that operates a trade or business is subject to the tax on net earnings from self employment in the same manner as a. Whether you function as an LLC or as Sole Proprietor, your taxes will be the same. Sole Proprietorship is less paperwork and quicker at the upstart. An LLC. The single member LLC is the simplest to form. It is taxed the same as a sole proprietorship. Profits or losses pass through to the owner via Schedule C. A. Plus, the owner and the business are the same, which means tax filing is an easy process. Many sole proprietors do their own taxes. An LLC is different. The. It is simple to form a sole proprietorship. You do not need to register, and it is easier to manage and file taxes. However, your personal assets are not. While the federal taxes paid should be the same for a sole proprietorship and an LLC being taxed as a pass-through entity, some states have additional taxes for. The single biggest advantage of an LLC over a sole proprietorship is personal liability protection. If you register your business as an LLC, your personal.

A single-member LLC is a "disregarded entity" for tax purposes—that is, it is taxed the same as a sole proprietorship. But sole proprietorships and single-. Sole proprietorships and partnerships do not offer the same personal liability protection. If you conduct business as a sole proprietor, you will not have. It's possible that's okay if the names are the same. That would mean you converted the sole proprietorship into an LLC. You may think you're. It's possible that's okay if the names are the same. That would mean you converted the sole proprietorship into an LLC. You may think you're. LLC are exactly the same taxes as sole proprietor for a single member LLC. You can also utilize business expense deductions with a sole. You'll owe the same federal taxes as a sole proprietorship unless you elect to be taxed as a corporation. However, your state might have filing fees, annual. The main difference between a Florida LLC and a Florida sole proprietorship depends on whether your LLC is single or multi-member. What is the difference between a business being sole proprietor and a Limited Liability Company (LLC)? · Easiest and least expensive form of ownership to. A single member Llc and sole proprietorship are the same thing for taxes. You don't need a llc to deduct business expenses. Upvote 1. Is a single-member LLC the same as a sole proprietorship? No, a single-member LLC is still a limited liability corporation. The business and the business. The default form of taxation for an SMLLC is a “disregarded entity.” This means the IRS ignores your LLC and treats it the same as a sole proprietor for tax. A single-member LLC is a 'disregarded entity' for federal tax purposes. (It still provides asset protection.) You report the income and the expenses of the. By default, single-member LLCs are taxed the same as a sole proprietorship. However, multi-member LLCs will distribute taxes based on the percentage each member. LLCs, give liability protection which is incredible if you own personal assets or have a family to protect them. Sole proprietorships are not protected. Start. A limited liability corporation, better known as an LLC, is a business structure that combines pass-through taxation (like in a partnership or sole. Unlike a sole proprietorship, an LLC is a hybrid of the partnership and corporate forms that allows the liability protection of a corporation with the tax. Sole proprietors file taxes as a part of their personal income tax returns. LLCs can also choose to do the same, but they have much more flexibility in choosing. A Limited Liability Company is a combination between a sole proprietorship and a corporation. This means that you get a bit of both worlds. An LLC means that. Being an LLC can also help convince wary clients that your business is stable. independent contractor vs. sole proprietor. Where this gets messy. The catch is. LLCs must include 'limited liability company' or LLC at the end of their chosen name. Sole proprietorships and partnerships cannot use words like corporation or.

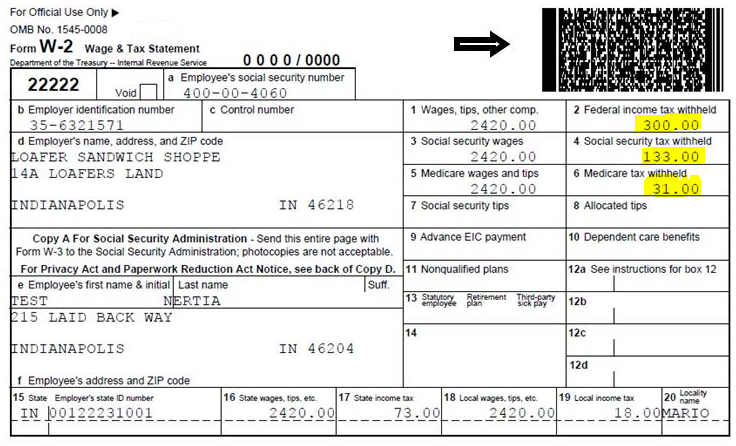

If I Make 52 000 How Much Tax Refund

For , incomes over $, that have already had the maximum Social Security tax of $$10, withheld will not have additional withholding. Please note. deductions if their total deductions There is also online tax filing software available that can make a complicated return much easier to complete. Use our income tax calculator to help forecast your federal income taxes before you file. Just enter your income and some details about your personal situation. refund should file their claim with their Michigan income tax return. tax credit which means that if the tax credit lowers a taxpayer's tax liability. Use SmartAsset's Tax Return Calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. make sure you have the right amount of tax withheld from your paycheck. Select a higher percentage for line 10 than line 9 if you want an overpayment (refund). What is a $52k after tax? $ Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your tax return and tax. If you make $70, a year living in Pennsylvania you will be taxed $9, Your average tax rate is % and your marginal tax rate is 22%. SmartAsset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Enter your info to see your take home pay. For , incomes over $, that have already had the maximum Social Security tax of $$10, withheld will not have additional withholding. Please note. deductions if their total deductions There is also online tax filing software available that can make a complicated return much easier to complete. Use our income tax calculator to help forecast your federal income taxes before you file. Just enter your income and some details about your personal situation. refund should file their claim with their Michigan income tax return. tax credit which means that if the tax credit lowers a taxpayer's tax liability. Use SmartAsset's Tax Return Calculator to see how your income, withholdings, deductions and credits impact your tax refund or balance due amount. make sure you have the right amount of tax withheld from your paycheck. Select a higher percentage for line 10 than line 9 if you want an overpayment (refund). What is a $52k after tax? $ Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your tax return and tax. If you make $70, a year living in Pennsylvania you will be taxed $9, Your average tax rate is % and your marginal tax rate is 22%. SmartAsset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Enter your info to see your take home pay.

If you make $70, a year living in Ohio you will be taxed $8, Your average tax rate is % and your marginal tax rate is 22%. make sure you have the right amount of tax withheld from your paycheck. Select a higher percentage for line 10 than line 9 if you want an overpayment (refund). We work out your Tax and NI figures for you. Our calculator uses standard Tax and NI calculations. Get specialist self-employed debt advice if your situation is. much tax to withhold from your pay for federal and state personal income taxes. State income tax refund is included in federal income (if itemized last year);. If you make $52, a year living in the region of New Jersey, USA, you will be taxed $9, That means that your net pay will be $42, per year, or $3, Enter your filing status, income, deductions and credits into the income tax calculator below and we will estimate your total taxes for It all comes down to how and when you get a tax break. Here's a quick comparison. Roth IRA. No immediate tax benefit for contributing; Contributions can be. Sorry OP it appears super normal. If you're convinced it's wrong you may be too cautious on your withholdings (it'll come to you in a tax refund. Maryland Unpaid Tax Interest Calculator ; Use this calculator to figure the interest on your unpaid Maryland Tax. ; Amount of Tax Due: ; Tax Return Due Date. Those items, listed below, should be subtracted when computing VTI. Age Deduction for Taxpayers Age 65 and. Discover how to calculate your tax refund with our straightforward guide and examples. Learn key steps to prepare and maximize your returns. This calculator helps you estimate your average tax rate, your tax bracket, and your marginal tax rate for the current tax year. This could be from claiming eligible deductions, overestimating your income tax bill or making voluntary super contributions. Our quick and simple tax refund. If you make $70, a year living in Ohio you will be taxed $8, Your average tax rate is % and your marginal tax rate is 22%. deductions if their total deductions There is also online tax filing software available that can make a complicated return much easier to complete. We suggest you lean on your latest tax return to make educated withholding changes. For example, if you received a tax refund, e.g. $1,, take that refund. § to allow an income tax deduction for otherwise deductible expenses if the payment for such expenses is made with the grant or loan program of the. If this employee's pay frequency is weekly (weekly = 52 pay periods per income so you don't owe tax later when filing your tax return. Step 4b: any. Get a clear picture of your tax liability without having to sign up. Estimate your small business taxes with Taxfyle's free, easy-to-use small business tax. With an annual salary of $52,, considering a federal tax rate of % and a state tax rate of %, your estimated monthly take-home pay after taxes.

Instagram Follow Limit Per Hour 2021

by jarvee. heroeslair February 16, , pm # I definitely do way more follows per hour on some of my accounts. But mine are warmed up already I guess. The good news is that there is no limit to how many accounts can follow you, which is how influencers and celebrities get a huge number of followers in such a. It prevents people and bots to follow thousands of accounts and then unfollow them after they got a follow back. Upvote. A driver traveling at 30 miles per hour who hits a pedestrian has a 45 Page last modified on November 19, Safe Roads for a Safer Future. Likes limits: per hour or per day. • Comments limits: per day. • Follow limit: 10 per hour or per day. Instagram Live videos, too, have a limit. You can go live for only up to four hours at once. This is a recent update, and the earlier limit was 60 minutes. Based on our account management experience, Instagram only allows you to follow / unfollow people per hour. Posts can be shared publicly or with preapproved followers. Users can browse other users' content by tags and locations, view trending content, like photos, and. the limit of follow/ unfollow on Instagram is per day. 10 per hour would be safe for your account as it won't be suspended. hope you got. by jarvee. heroeslair February 16, , pm # I definitely do way more follows per hour on some of my accounts. But mine are warmed up already I guess. The good news is that there is no limit to how many accounts can follow you, which is how influencers and celebrities get a huge number of followers in such a. It prevents people and bots to follow thousands of accounts and then unfollow them after they got a follow back. Upvote. A driver traveling at 30 miles per hour who hits a pedestrian has a 45 Page last modified on November 19, Safe Roads for a Safer Future. Likes limits: per hour or per day. • Comments limits: per day. • Follow limit: 10 per hour or per day. Instagram Live videos, too, have a limit. You can go live for only up to four hours at once. This is a recent update, and the earlier limit was 60 minutes. Based on our account management experience, Instagram only allows you to follow / unfollow people per hour. Posts can be shared publicly or with preapproved followers. Users can browse other users' content by tags and locations, view trending content, like photos, and. the limit of follow/ unfollow on Instagram is per day. 10 per hour would be safe for your account as it won't be suspended. hope you got.

Effective January 1, , the minimum wage is $ per hour for all follow the stricter standard; that is, the one that is the most beneficial. Follow. Albany City Hall. Photo shared by Gabriella A. Romero on limit from 30 to 25 miles per hour. Thank you to Councilmember Zamer. The federal minimum wage for covered nonexempt employees is $ per hour. Many states also have minimum wage laws. In cases where an employee is subject. Below How you use Instagram, tap Time spent. Tap Daily limit. Choose an amount of time and tap Turn on. You can also see. To help reduce spam, Instagram doesn't allow anyone to follow more than 7, people. follow and how many posts you can like. Regarding the number of likes and follows per hour, the maximum is And if the account is new, the maximum is. Follow. Photo by Lauren Williams on September 08, May be an image of 3 Photo by Lauren Williams on July 26, 23, likes. Set it on automatic and follow up to 1 profile per hour. Auto unfollow Instagram profiles that don't follow you back. Take note: For an. Voters approved the minimum wage ordinance on November 12, The ordinance set an hourly rate of pay that employers must pay their workers for work. Likes: per hour, or – per. DayDMs: 50–70 per proline-penza.ruts: per proline-penza.ru limit: per proline-penza.ru tag limit: 20 people per post. Instagram Action Limits · follows per hour / follows per day · likes per day · comments per hour · 10 DMs per hour. for hours to see the content from all the profiles we follow. That's why it's even more important than ever to create interesting, catchy and engaging. The daily limit, however, increases with the age of your Instagram account. More established accounts can post. The recommended Instagram limits for an account that is mature enough to avoid getting blocked are: do not follow or unfollow more than 30 accounts per hour;. hour limit and posted to an Instagram profile. You can find them in the small circles under an Instagram bio. Story Highlights are a fantastic way to. M Followers, Following, Posts - Cardi B (@iamcardib) on Instagram: "". Follow limit: 7–13 followings per hour or – followings per day are allowed during your waking period, which gives a maximum of – Photo by Rob Mitchell Calculations suggest I'll need in the region of 90G of carb per hour. Also, the FLSA does not limit the number of hours in a day or days in a week an employee may be required or scheduled to work, including overtime hours, if the.

Invest $1000 Right Now

So what's the right investment strategy? Sure, long-term works. Real estate Now, if you're an advanced trader, you likely understand that market. So, what do you do instead? You can invest in some mutual funds. Four percent can beat the market, or ETFs, or index funds - where you don't. ETFs and mutual funds are a good way to get started because they both involve investing in an already diversified portfolio that other people do. Happy New Year Money Guy Show Family! There has never been a better time to buy into the market and start investing than right now! Now what do you want if you want a steady growth then go for the VTI (that's a stock symbol) and other ETFs. Or do you want to go aggressive, if. Most millionaires invest in stocks. Why? Because stocks have historically increased in value. For example, here is Nvidia's historical performance. How to invest $1, Key things to know · Investing even small sums consistently can help your money grow over time. · Setting clear financial goals, like saving. If you want to invest $1, as passively as possible, using a robo-advisor is your best option. Robo-advisors automate your investing strategy by investing. The best ways to invest $1, right now · 1. Stocks and ETFs · 2. Use a robo-advisor · 3. Chip away at high-interest debt · 4. Use real estate crowdfunding. So what's the right investment strategy? Sure, long-term works. Real estate Now, if you're an advanced trader, you likely understand that market. So, what do you do instead? You can invest in some mutual funds. Four percent can beat the market, or ETFs, or index funds - where you don't. ETFs and mutual funds are a good way to get started because they both involve investing in an already diversified portfolio that other people do. Happy New Year Money Guy Show Family! There has never been a better time to buy into the market and start investing than right now! Now what do you want if you want a steady growth then go for the VTI (that's a stock symbol) and other ETFs. Or do you want to go aggressive, if. Most millionaires invest in stocks. Why? Because stocks have historically increased in value. For example, here is Nvidia's historical performance. How to invest $1, Key things to know · Investing even small sums consistently can help your money grow over time. · Setting clear financial goals, like saving. If you want to invest $1, as passively as possible, using a robo-advisor is your best option. Robo-advisors automate your investing strategy by investing. The best ways to invest $1, right now · 1. Stocks and ETFs · 2. Use a robo-advisor · 3. Chip away at high-interest debt · 4. Use real estate crowdfunding.

Park cash you don't plan to use right away in a low-risk investment while avoiding high market risk. Investment minimum: $1,, with additional purchases in. How can I turn $10, into $1,, in one to five years? Right now I decided to invest $10k in. How to invest $1, right now — wherever you are on your financial journey · 1. Build an emergency fund · 2. Pay down debt · 3. Put it in a retirement plan · 4. Invest in a pressure washer and a carpet shampooer, a bucket, and some wax/cleaning stuff. Start auto detailing and make more money. Paying down debt or creating an emergency fund is a way to invest $1, · Investing $1, in an exchange-traded fund (ETF) allows investors to diversify and. Paying down debt or creating an emergency fund is a way to invest $1, · Investing $1, in an exchange-traded fund (ETF) allows investors to diversify and. This way of investing has a low-risk level, it's FDIC-insured, so you don't have to worry about losing your investments, has an annual percentage yield (APY) of. The best ways to invest $1, right now · 1. Stocks and ETFs · 2. Use a robo-advisor · 3. Chip away at high-interest debt · 4. Use real estate crowdfunding. How to Invest $1, Right Now · With a net worth of more than $16 billion, Ray Dalio is the 91st richest person in the world. · Founder and co-chief investment. General advice is that you shouldn't invest money you need in less than 5 years. year horizon I would use i series bonds, or a CD. Business · The Best Stocks to Invest $1, in Right Now · The Stock Market Just Did Something Not Seen Since the Year Here's What History Says Happens Next. Where to Invest $1, Right Now! Put Your Money to Work · Creating an emergency fund can help you cover unexpected expenses and maintain your peace of mind. On the other hand, if you only invest $ this month, only $ will earn compound returns as of now. investment journey on the right track? You can. Hot Stocks: Here's Where to Invest $1, Right Now · Buy This $5 Stock BEFORE This Apple Project Goes Live · Did Elon Musk Just Trigger a New Netscape Moment? Calculate your investment earnings. Are you on track to reach your investment goal? Find out using Bankrate's investment calculator below. Start investing on your own with self directed investing through Vanguard. Explore our helpful guides and tools to choose the right investments for you. Where to Invest $10, Right Now · Emphasize Income. Before the market's recent rally sputtered out, many were asking if it was time to start adding back equity. AbbVie (ABBV), Vertex Pharmaceuticals (VRTX), Murphy (MUSA), MasterCraft Boat (MCFT), and PrimeEnergy Resources (PNRG) might be the best stocks to invest $ Paying down debt or creating an emergency fund is a way to invest $1, · Investing $1, in an exchange-traded fund (ETF) allows investors to diversify and. Active: You use your brokerage account to access various investments, including stocks, bonds, and other assets, and trade as you wish. You'll set your goals.

Insurance For Art Work

With Chubb art insurance, you're automatically covered for new purchases worldwide, whether they're at your home, a gallery, or in storage. Fine Art insurance coverage highlights · Unique properties may be eligible for protection, including fine art, collectibles, musical instruments, stamps and. Art insurance helps protect your fine art beyond what a homeowners or renters policy covers. Plus, there's no deductible. We're proud to be the caretaker of the insurance needs of artists country-wide. Insurance for Artists by Zinc is designed to be reasonable, practical. Artists Event Insurance from Insurance Canopy provides same-day liability coverage for artists that attend events in person or sell their products online. These are not homeowners rider policies. They insure collections of art, wine, stamps, coins, memorabilia They are both no hassle, AXA is well. You can get Extra Coverage for up to $20, worth of artwork, total. That could be one major artwork that's worth $20,, or twenty pieces each worth $1, The Gallagher Fine Arts insurance and risk management coverages work with the world's premier art institutions and galleries to protect and preserve some of. Art Insurance Now policies are tailored to cover works of art while on or off premises, in transit, storage, in exhibition, in a Museum, Auction house, and. With Chubb art insurance, you're automatically covered for new purchases worldwide, whether they're at your home, a gallery, or in storage. Fine Art insurance coverage highlights · Unique properties may be eligible for protection, including fine art, collectibles, musical instruments, stamps and. Art insurance helps protect your fine art beyond what a homeowners or renters policy covers. Plus, there's no deductible. We're proud to be the caretaker of the insurance needs of artists country-wide. Insurance for Artists by Zinc is designed to be reasonable, practical. Artists Event Insurance from Insurance Canopy provides same-day liability coverage for artists that attend events in person or sell their products online. These are not homeowners rider policies. They insure collections of art, wine, stamps, coins, memorabilia They are both no hassle, AXA is well. You can get Extra Coverage for up to $20, worth of artwork, total. That could be one major artwork that's worth $20,, or twenty pieces each worth $1, The Gallagher Fine Arts insurance and risk management coverages work with the world's premier art institutions and galleries to protect and preserve some of. Art Insurance Now policies are tailored to cover works of art while on or off premises, in transit, storage, in exhibition, in a Museum, Auction house, and.

An insurance contract is said to be agreed value, when the insured determines the value of works of art in concert with the insurer. In this case, it is common. By purchasing your own artist liability insurance policy, you not only prevent potential liability risks, but also demonstrate to clients and event organizers. Therefore, close collaboration with an art insurance company throughout the process of artwork transportation is always a wise decision that will help you. It's very important to make sure artworks that you own are correctly insured. Most likely your HOMEOWNERS insurance company does not cover your art unless you. Affordable insurance for artists in the studio, online, and on the go. ACT Pro Starting at $/Month ACT Go Starting at $49/Event. Art Insurance Policies are tailored to cover works of art at the Studio, in Storage, at Exhibitions, with Dealers, and during Transit. Therefore, close collaboration with an art insurance company throughout the process of artwork transportation is always a wise decision that will help you. Whether you own one piece of art or a world-renowned collection, Higginbotham can cover it. Some of the industry professionals we serve include: Artists. Art collections coverage Paintings, sculptures, prints, special collections of historical, cultural and technological significance and more can be insured. Ultimart prides itself on offering bespoke cover as a specialist fine art insurance broker. The 'All Risks' policy ensures your art is safeguarded against. The Cost of Art Insurance. Most insurance brokers will offer Title Insurance policies that usually cover between 1% and 7% of the total value of the artwork. You may need property insurance. This will cover all of the tools, equipment and artwork you have in the space. It will not, however, cover any artwork once it. Fine art property insurance provides compensation if the piece or pieces of artwork named on the policy are damaged, lost, or stolen. The types (and value) of art and collectibles that people own can vary widely, so coverage requirements vary accordingly. A standard homeowners insurance. Why you need business insurance for your art business · Loss of property like tools, supplies, and artwork from risks like fire, natural disasters, lightning. Fine art insurance covers a variety of art collections, including paintings, sculptures, rare books, historical artifacts, scientific inventions and more. Whether you have a carefully curated art or wine collection or pieces of precious jewelry, add customized insurance protection to your home coverage. Is my art covered by my home insurance? You can cover fine art under your contents insurance policy, but there may be limits on how much a single item can be. Artwork insurance is a type of insurance that covers paintings, sculptures, and other valuable pieces of art if they are damaged, destroyed, or stolen. Art insurance helps protect your investment and also ensures that you can continuing collecting should something catastrophic happen. To prepare adequately for.

Explain Ebitda In Simple Terms

It's a measure of corporate profitability that represents cash profit generated by company operations. In simple terms, EBITDA is your company's net income . Multiples is one such word. In simpler terms, multiples are the marketplace's perception of potential growth of a business. If two businesses run in similar. The acronym EBITDA stands for earnings before interest, taxes, depreciation, and amortization. EBITDA is a useful metric for understanding a business's ability. When we talk about EBITDA, we simply pertain to the net income or earnings with added interest, taxes, depreciation, and amortization expense. EBITDA, or earnings before interest, taxes, depreciation, and amortization is a financial performance metric sometimes used as an alternative to net. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. Just saying all of those words out loud can feel overwhelming. EBITDA means Earnings Before Interest Tax Depreciation and Amortisation. · As the name suggests, it is a calculation of net profit for a year. EBITDA Definition: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a proxy for a company's core, recurring business cash flow from. It stands for earnings before interest, taxes, depreciation, and amortisation. To understand what each part of this means, see How to calculate EBITDA below. As. It's a measure of corporate profitability that represents cash profit generated by company operations. In simple terms, EBITDA is your company's net income . Multiples is one such word. In simpler terms, multiples are the marketplace's perception of potential growth of a business. If two businesses run in similar. The acronym EBITDA stands for earnings before interest, taxes, depreciation, and amortization. EBITDA is a useful metric for understanding a business's ability. When we talk about EBITDA, we simply pertain to the net income or earnings with added interest, taxes, depreciation, and amortization expense. EBITDA, or earnings before interest, taxes, depreciation, and amortization is a financial performance metric sometimes used as an alternative to net. EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. Just saying all of those words out loud can feel overwhelming. EBITDA means Earnings Before Interest Tax Depreciation and Amortisation. · As the name suggests, it is a calculation of net profit for a year. EBITDA Definition: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a proxy for a company's core, recurring business cash flow from. It stands for earnings before interest, taxes, depreciation, and amortisation. To understand what each part of this means, see How to calculate EBITDA below. As.

Let's start with a definition: EBITDA stands for earnings before interest, taxes, depreciation, and amortization. Another way to think about it is your. In simple terms, EBITDA is a measure of a company's financial performance, acting as an alternative to other metrics like revenue, earnings, or net income. It is a popular and widely used metric that allows for a direct comparison between companies in terms of what they each earn, as it strips out expenses that. EBITDA is Earnings, Before, Interest, Taxes, Depreciation, and Amortization (which is like depreciation for non-physical property). It's. Earnings Before Interest, Taxes, Depreciation, and Amortisation, or EBITDA, is a statistic used to assess a company's operating performance. It is a proxy for. EBITDA is a business analysis metric used to evaluate a company's financial health and long-term profitability. The acronym stands for earnings before interest. What is EBITDA? EBITDA stands for Earnings, Before Interest, Taxes, and Depreciation. EBITDA is one of the most common Profit metrics in the Finance world. In other words, EBITDA equals net income plus interest, taxes, depreciation and amortization expenses. Ron Auerbach, a professor at City University of Seattle. What is EBITDA? EBITDA refers to a company's earnings (i.e profit) before deducting interest expenses, taxes, depreciation, and amortisation. It is an acronym. What is EBITDA? EBITDA is an accounting method to calculate a company's net profits (or earnings). It is an acronym for: earnings before interest; taxes. EBITDA or Earnings Before Interest, Tax, Depreciation, Amortization is a company's profits before any of these net deductions are made. What is EBITDA? Definition and explanation EBITDA is an acronym that stands for "earnings before interest, tax, depreciation, and amortization". The term. What is EBITDA? EBITDA is a way of evaluating a company's performance without factoring in financial decisions or the tax environment. The literal meaning of. Compact Explanation. EBITA stands for Earnings Before Interest, Taxes, and Amortization. Introduction. EBITDA is a critical financial metric used to evaluate. EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortization. Find out what this metric is, and how to calculate it! EBIAT: Earnings before interest after taxes. This calculation provides a simpler understanding of a business's post-tax earnings before interest payments are. Earnings before interest, taxes, depreciation and amortization · Language · Watch · Edit. It is the simplest ratio to prove a firm's business value in terms of operating costs relative to total revenues. EBITDA: Pros And Cons. There are a lot of. What is EBITDA? EBITDA is the most common measure of the earnings of a company in the middle market. EBITDA allows a buyer to quickly compare two companies. EBITDA is the amount of profit that a person or company receives before interest, taxes, depreciation, and amortization have been deducted. Supporters of EBITDA.

Best Way To Pay Off Credit Card Balance

Paying off your credit card debt each month is one of the most consistent ways to help improve your credit scores. But when in the month is the best time to pay. Once it's paid off, you can roll that payment toward the next-smallest balance. The debt avalanche is the best financial option since you'll save more money on. The best strategy for paying off credit card debt at the lowest cost is the “avalanche method.” Basically, you start by paying as much as. Paying off your credit card · Follow these steps to work out what you need to do · Cut the cost of your credit card debt · Cut the cost of your credit card debt. Use financial windfalls. Commit raises, bonuses or other financial windfalls to debt reduction rather than adding these funds to your monthly spending pool. This calculator will give you monthly payment plans for up to 8 credit cards or loans. A debt consolidation loan may work similarly to a balance transfer card. Debt consolidation loans are personal loans you can use to pay off multiple debts and. Other experts recommend paying off credit cards with the highest interest rate first – which saves you money in accrued interest. Either way, the goal is to. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our. Paying off your credit card debt each month is one of the most consistent ways to help improve your credit scores. But when in the month is the best time to pay. Once it's paid off, you can roll that payment toward the next-smallest balance. The debt avalanche is the best financial option since you'll save more money on. The best strategy for paying off credit card debt at the lowest cost is the “avalanche method.” Basically, you start by paying as much as. Paying off your credit card · Follow these steps to work out what you need to do · Cut the cost of your credit card debt · Cut the cost of your credit card debt. Use financial windfalls. Commit raises, bonuses or other financial windfalls to debt reduction rather than adding these funds to your monthly spending pool. This calculator will give you monthly payment plans for up to 8 credit cards or loans. A debt consolidation loan may work similarly to a balance transfer card. Debt consolidation loans are personal loans you can use to pay off multiple debts and. Other experts recommend paying off credit cards with the highest interest rate first – which saves you money in accrued interest. Either way, the goal is to. This means you could transfer your credit card debt and not have to deal with interest for several months or even a year (depending on the card). While our.

There are two methods when it comes to paying off your credit card debt: the avalanche method or the snowball method. With the avalanche method, you pay the. How To Pay off Credit Card Debt · 5 Steps To Assess Your Spending · Commit to a Payment Amount · Choose a Payment Strategy · Consider Balance Transfer Credit Cards. Ways to pay off your credit card debt · 1. Pay more than the minimum requirement · 2. Switch to a credit card with a lower interest rate · 3. Spread out your. An easy way to pay is by direct debit or automatic transfer from your bank account each month. Set it for the day after your pay goes in, so you have enough. How to pay off credit card debt: 7 tricks · 1. Understand how the debt happened · 2. Consider debt payoff strategies · 3. Pay more than the minimum · 4. Reduce. Strategies to help pay off credit card debt fast · 1. Review and revise your budget. · 2. Make more than the minimum payment each month. · 3. Target one debt at. The most efficient way to pay down credit card debt is by giving serious attention to a monthly budget. While studies show that 70% or more Americans think it's. Trying to eliminate all of your debt? Keeping credit accounts open, and paying the balances in full every month, may help you maintain or increase your credit. You can tackle your debt in order of highest to lowest interest rate % (the avalanche method), or you can pay off the smaller debts first to get yourself on a. So, how do you increase your credit score? Paying your bills on time and lowering your debt burden are the two best solutions, but there are more ways to. Once that card is paid off, you'll take the monthly payment you were putting toward it and apply that to the card with the next-lowest balance (on top of its. Snowball method: With this method, you prioritize paying off your credit card debts with the lowest balances first. The first balance may be small, but you feel. The Verdict: Citi Simplicity® Card is one of the best balance transfer offers available. If you want a long period of time to pay down your balance, you've. Paying off credit card debt. What are my options? Try to pay what you can afford towards your credit card. More interest is added as the balance gets bigger. The best way to pay off debt and raise your credit score is to repay balances with the highest interest rates first. This will reduce the overall cost of. Avalanche method: pay highest APR card first Paying off your credit card with the highest APR first, and then moving on to the one with the next highest APR. This will keep the payment history portion of your FICO score in good proline-penza.ru you can afford to pay of your debt quickly, do it! Not only will it improve. The best way to pay your credit card bill is by paying the statement balance on your credit bill by the due date each month. Doing so will allow you to avoid. 1. Continue to Pay Your Credit Card Bills on Time · 2. Practice Responsible Spending · 3. Choose a Credit Card Payment Strategy · 4. Make Sure You Have an. It is always best to pay off your credit card balance in full by the due date indicated on your statement. If you can't, you can still reduce the amount of.

Usa Local Banks Name

The Name & Location Search allows you to find FDIC-insured banks and branches from today, to last year, and all the way back to 69% of U.S. adults recognize the importance of banking with a locally based financial institution.*. Bank Locally Banking Community. 70% of U.S. adults cite. 1. JPMorgan Chase – $ trillion · 2. Bank of America – $ trillion · 3. Wells Fargo – $ trillion · 4. Citibank – $ trillion · 5. U.S. Bank – $ American State Bank – Banking for you. American State Bank and Trust Company – Real People. Real Relationships. American West Bank – Simply Better Banking Amica. Includes a list of U.S. banks operating in the market; indicates whether Ex-Im Bank offers any country-specific programs. Virtually all Colombian banks have. We're your community bank for savings accounts, checking, mortgages, HELOCs, personal & auto loans and wealth management. Enjoy our top-tier financial. Arvest Bank · Associated Bank · BancorpSouth · Bank of the West · BMO Harris Bank · California Bank & Trust · Carter Bank & Trust · Chemical Bank. BIGGEST BANKS IN UNITED STATES · Chase Bank. Offices in 49 States · Wells Fargo Bank. Offices in 37 States · Bank of America. Offices in 39 States. Search by Bank Name. To search by specific bank name, the Federal Financial Institutions Examinations Council (FFIEC) offers a financial institution search. The Name & Location Search allows you to find FDIC-insured banks and branches from today, to last year, and all the way back to 69% of U.S. adults recognize the importance of banking with a locally based financial institution.*. Bank Locally Banking Community. 70% of U.S. adults cite. 1. JPMorgan Chase – $ trillion · 2. Bank of America – $ trillion · 3. Wells Fargo – $ trillion · 4. Citibank – $ trillion · 5. U.S. Bank – $ American State Bank – Banking for you. American State Bank and Trust Company – Real People. Real Relationships. American West Bank – Simply Better Banking Amica. Includes a list of U.S. banks operating in the market; indicates whether Ex-Im Bank offers any country-specific programs. Virtually all Colombian banks have. We're your community bank for savings accounts, checking, mortgages, HELOCs, personal & auto loans and wealth management. Enjoy our top-tier financial. Arvest Bank · Associated Bank · BancorpSouth · Bank of the West · BMO Harris Bank · California Bank & Trust · Carter Bank & Trust · Chemical Bank. BIGGEST BANKS IN UNITED STATES · Chase Bank. Offices in 49 States · Wells Fargo Bank. Offices in 37 States · Bank of America. Offices in 39 States. Search by Bank Name. To search by specific bank name, the Federal Financial Institutions Examinations Council (FFIEC) offers a financial institution search.

W · WaFd Bank, Seattle, United States · Walser Privatbank, Hirschegg, Austria · Warka Bank, Baghdad, Iraq · WeBank (Italy), Milan, Italy · Webster Financial Corp. It allows you to have the same face-to-face interaction that you would have in your local branch but without leaving your home. name for U.S. Bancorp. Local banks value each of their customers as individuals, often greeting them by name and asking about their families and lives. Local banks pride themselves on. There are 4, FDIC-insured commercial banking institutions in the U.S. as of but 72, commercial bank branches. Most banks have at least one physical. 1, JPMorgan Chase · New York City ; 2, Bank of America · Charlotte, North Carolina ; 3, Citigroup · New York City ; 4, Wells Fargo · San Francisco, California. The first and most obvious way to open a US bank account as a non-resident is to open an account with a big-name US bank. Local bank details not just in the. Byline Bank Named in U.S. News & World Report's That's why we combine the local touch of a neighborhood bank with the reach of a national one. Are You Banking With a Community Bank? · Why It Matters · You Have Choices · Common Questions · Tips and Blogs · Independent Community Bankers of America. Heritage Bank has been building lasting relationships and helping customers with their banking needs for over 95 years. See how we're different. Checking & Savings. Together. · Products & Services · The Safest Plan is. Often the Smartest One · Insights · Financial Wellness · Mobile App · Contact Us · SUPPORT. Data is as of Q1 from FDIC Call Reports. · Community Banks are Local Banks. Community Banks are chartered across all states and in markets of varying. Bank of America, N.A. - National Bank (Out of State) Walnut Avenue NJ Cranford, NJ , Mr. Brian Moynihan, CEO () Holding Company. The Name & Location Search allows you to find FDIC-insured banks and proline-penza.ru · Contact Us · Privacy · Plain Writing · No Fear Act Data · Inspector General. When you bank with United Community, you will enjoy convenient access to your personal or business accounts at any of our branches, online or through our. If you are a foreigner or non-resident in the USA looking for the best US bank account, read our list. We explore the best bank account for immigrants. Meet with a financial specialist. Personal banker. Schedule time with a local banker to handle your. Banks in the U.S. offer many kinds of financial services, including: The Greater Bloomington Chamber of Commerce has a list of local banks. See a. Includes a list of U.S. banks operating in the market; indicates whether Ex-Im Bank offers any country-specific programs. Holding Company: Kearny Financial Corp. Regulator: New Jersey Department of Banking and Insurance · KEB Hana Bank USA, National Association - National Bank Find information about the management and structure of HSBC in the US and its support for local communities.

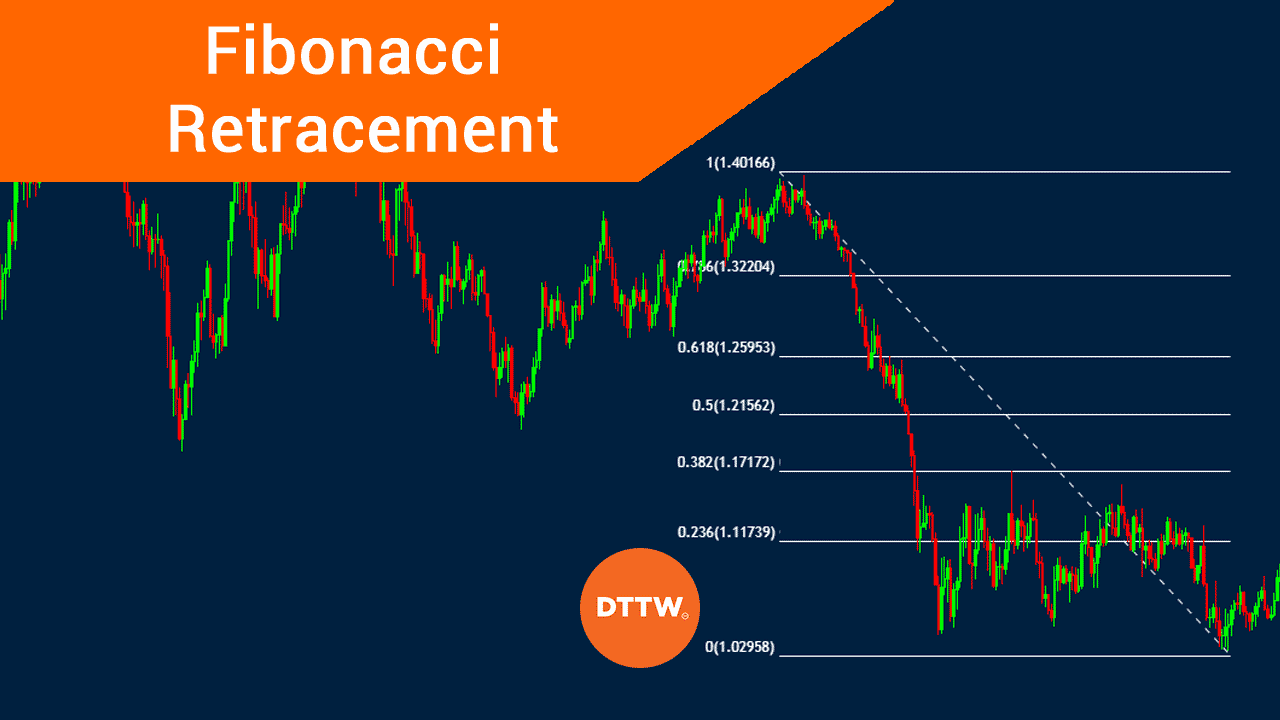

Trading Fibonacci Numbers

The Fibonacci ratios, ie %, %, and %, help the trader identify the retracement's possible extent. The trader can use these levels to position. The Fibonacci sequence in trading can provide you with clear market entries and exits so that you can set up conditions for automatic orders using our. Fibonacci retracements are popular tools that traders can use to draw support lines, identify resistance levels, and place stop-loss orders. Instead, they are used as guides in conjunction with other indicators to make trading decisions. The Fibonacci Sequence. Why are Fibonacci retracements named as. The Fibonacci sequence is relevant to financial markets because it is used to identify potential levels of support and resistance for a financial asset's price. In technical stock trading, these lines are set at %, % and %. It is worth noting that even these values form a Fibonacci sequence. While it is not. Fibonacci retracement is a technical analysis term referring to support or resistance areas that is used by both active and long-term traders. Traders can use Fibonacci retracement levels to determine where to place orders to enter and exit. For example, if a trader believes that the price of an. Fibonacci ratios can help technical traders identify areas of support, resistance, and retracement. The Fibonacci ratios, ie %, %, and %, help the trader identify the retracement's possible extent. The trader can use these levels to position. The Fibonacci sequence in trading can provide you with clear market entries and exits so that you can set up conditions for automatic orders using our. Fibonacci retracements are popular tools that traders can use to draw support lines, identify resistance levels, and place stop-loss orders. Instead, they are used as guides in conjunction with other indicators to make trading decisions. The Fibonacci Sequence. Why are Fibonacci retracements named as. The Fibonacci sequence is relevant to financial markets because it is used to identify potential levels of support and resistance for a financial asset's price. In technical stock trading, these lines are set at %, % and %. It is worth noting that even these values form a Fibonacci sequence. While it is not. Fibonacci retracement is a technical analysis term referring to support or resistance areas that is used by both active and long-term traders. Traders can use Fibonacci retracement levels to determine where to place orders to enter and exit. For example, if a trader believes that the price of an. Fibonacci ratios can help technical traders identify areas of support, resistance, and retracement.

Fibonacci trading is a popular technique used by traders to predict price movements in financial markets. This strategy is based on the mathematical. traders and for good reasons. The Fibonacci is a universal trading concept Fibonacci sequence and how to use the Fibonacci extensions for your trading. Fibonacci sequence is obtained by adding two preceding numbers. The ratios and percentages obtained from the Fibonacci sequence are considered to be levels to. Fibonacci retracement levels are prices, depicted as horizontal lines on a chart, that indicate where support or resistance could likely to occur. Fibonacci retracements are a popular technical analysis tool that help traders to identify future price movements. Learn more about Fibonacci trading. Fibonacci retracements are popular tools that traders can use to draw support lines, identify resistance levels, and place stop-loss orders. Fibonacci is short for Fibonacci retracement. This is a technical analysis method utilizing ratios based on the Fibonacci sequence to determine pullback support. What are Fibonacci retracements? Fibonacci retracement levels are horizontal lines that indicate where price reversals are likely to occur and are part of. Fibonacci retracement levels are the favorite technical analysis tool of swing and scalping traders. They are based on a harmonic mathematical sequence with. A series of six horizontal lines are drawn intersecting the trend line at the Fibonacci levels of %, %, %, 50%, %, and %. Chart: Fibonacci. A Fibonacci sequence is formed by taking 2 numbers, any 2 numbers, and adding them together to form a third number. Then the second and third numbers are added. The next number is (0 + 1) one, followed by (1 + 1) two and so on. Here's what the beginning of the sequence looks like: Fibonacci sequence. That might look a. The Fibonacci sequence, discovered around by the Italian mathematician, is an infinite sequence of numbers in which 1 appears twice as the first two. Fibonacci sequence can manifest in market price movements Ultimately, the effectiveness of Fibonacci numbers in trading and investing is a matter of personal. That % is a Fibonacci number and will then give the trader a better idea of where he or she thinks gold will do next. It may sound crazy that an. In finance, Fibonacci retracement is a method of technical analysis for determining support and resistance levels. It is named after the Fibonacci sequence of. An oversold RSI (below 30) at a Fibonacci support level can indicate a potential buying opportunity. An overbought RSI (above 70) at a Fibonacci resistance. The Fibonacci sequence describes a list of numbers where each one equals the sum of the two preceding numbers, carrying on to infinity. Another Fibonacci trading technique that uses time is the Fibonacci time zones. It projects time extensions using Fibonacci numbers instead of Fibonacci ratios. Fibonacci retracement levels are support and resistance levels that are based on the Fibonacci numbers. Those are %, %, %, and %.

How To Dispute Negative Information On Credit Report

If you find inaccurate information or an error on your credit report, you need to contact the credit reporting agency that prepared the report to file a credit. Your only recourse now is obtaining your credit report from each of the three credit bureaus, and dispute it through the credit bureau. Then the. What documents will I need to provide for my dispute? · Personal Information. Valid driver's license; Birth certificate · Account Information. Current bank. Keep copies of your dispute letter and enclosures. In addition to writing to the credit reporting agency, tell the creditor or other information provider in. Include your complete contact information. Filing a dispute with each credit bureau, instead of the lender or bank, offers protections governing how quickly it. You must make your dispute directly to the credit-reporting agency. Although the Fair Credit Reporting Act does not require it, the Federal Trade Commission. What you should know · Information that can't be on your credit report · You have the right to dispute anything in your credit report · If you notice suspicious. You can remove incorrect information from credit reports fairly easily as you file a report with each credit agency with the issue. They will do. Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be. If you find inaccurate information or an error on your credit report, you need to contact the credit reporting agency that prepared the report to file a credit. Your only recourse now is obtaining your credit report from each of the three credit bureaus, and dispute it through the credit bureau. Then the. What documents will I need to provide for my dispute? · Personal Information. Valid driver's license; Birth certificate · Account Information. Current bank. Keep copies of your dispute letter and enclosures. In addition to writing to the credit reporting agency, tell the creditor or other information provider in. Include your complete contact information. Filing a dispute with each credit bureau, instead of the lender or bank, offers protections governing how quickly it. You must make your dispute directly to the credit-reporting agency. Although the Fair Credit Reporting Act does not require it, the Federal Trade Commission. What you should know · Information that can't be on your credit report · You have the right to dispute anything in your credit report · If you notice suspicious. You can remove incorrect information from credit reports fairly easily as you file a report with each credit agency with the issue. They will do. Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be.

Keep copies of your dispute letter and enclosures. In addition to writing to the credit reporting agency, tell the creditor or other information provider in. That way, you don't have to spend hours tracking down who at “the bank” or other large creditor verified adverse information with the credit reporting. You should start the dispute directly with the credit bureau that has the inaccurate information, and this can be done online or via mail. If the dispute. Some companies claim to be able to get negative information cleared from your credit report. If your report contains incorrect information, you can contact the. This can be done easily by completing the proper forms and mailing or faxing them to the bureau. While you may have to fill out different forms or details with. reporting company or information provider won't correct the information I dispute? How long can a consumer reporting company report negative information? You can't rid every negative notation from your file – credit bureaus are obligated to report all credit and debt information as long as it is correct and. Accurate information cannot be removed from a credit report, even if a dispute is filed. As a lender that furnishes information to credit reporting agencies–. contact the creditor directly · file another dispute with the credit reporting agency but include more information · file a complaint about the credit reporting. Negative information is data in a consumer's credit report that lowers their credit score. Credit reports also contain positive information such as on-time. If you see information on your credit reports you believe is incomplete or inaccurate, a good first step is to contact the lender or creditor directly. This is. Learn more about how to dispute a credit report. You can file a dispute if you believe your TransUnion credit report contains inaccurate information. The most important is to provide complete, accurate information with your disputes. For sheer efficiency, the fastest way to file a dispute with a credit bureau. If you contest the completeness or accuracy of information in your report, you should file a dispute with the credit bureau and with the company that furnished. Write a formal dispute letter to the credit bureau(s) reporting the negative item. In the letter, clearly state the reason for your dispute and provide any. Accurate information cannot be removed from a credit report, even if a dispute is filed. As a lender that furnishes information to credit reporting agencies–. That way, you don't have to spend hours tracking down who at “the bank” or other large creditor verified adverse information with the credit reporting. If there is incorrect information in your credit report, you may ask the credit reporting agency to investigate. For most items, you must do so in writing and. 5. Follow Up If Your Dispute is Rejected What if the credit bureau comes back claiming the negative information is verified as accurate? Don't give up. You. Look for some form of the word “dispute” in the Notes portion of the account's information to identify a disputed account. Unfortunately, disputed accounts are.

1 2 3 4 5